This is a sponsored post for SheSpeaks/Prudential.

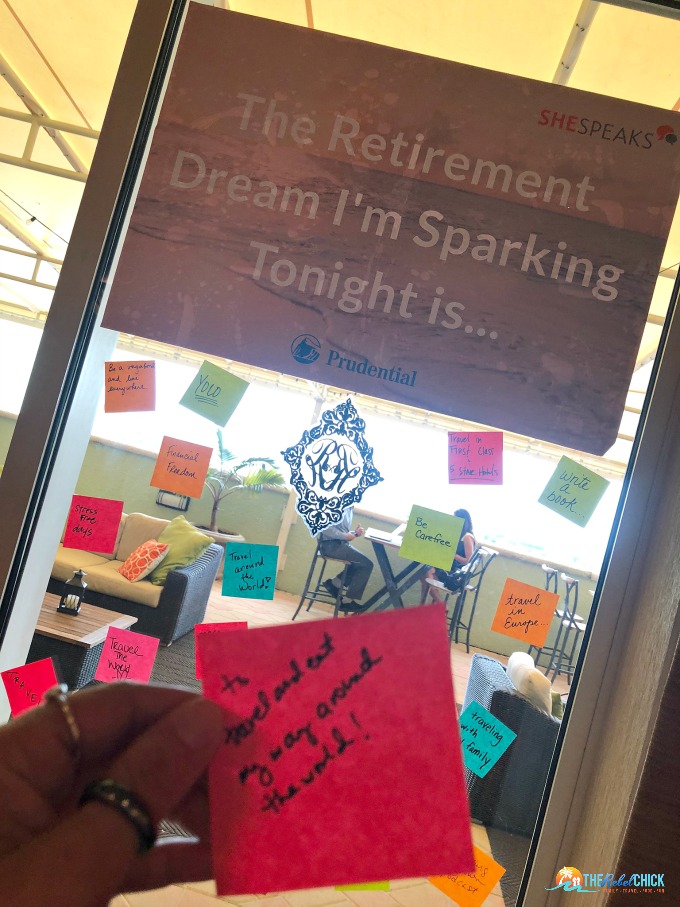

As I begin to slowly come to terms with the fact that I am officially "in my 40s," I am beginning to think about what my retirement will look like. I think we all begin to think about our golden years as we reach this point as: Who really wants to continue working forever? While at a Prudential event recently, I was asked what my dream retirement would look like, and I did not have to think about this very long. Now, unless I win the lottery any time soon, my retirement is a good many years away - but I already know how I want to spend it: doing absolutely nothing. I want to buy a little cottage in a quiet beach town, go swimming each day, eat delicious, fresh local food, spend each evening with a good book, and fall asleep to the sounds of waves crashing outside my bedroom window. This may seem like a very boring retirement to many of you, but hey, my life thus far has been a whirlwind of excitement and I am looking forward to a time in my life when I have no one to answer to and nothing pressing to do! Unfortunately, spending your retirement years in a quiet beach town isn't exactly cheap! Regardless of how you want to spend your retirement years, it will not be "free" - and that is why you should Learn Why You Should Be Thinking About Securing A Protected Lifetime Income.

Learn Why You Should Be Thinking About Securing Protected Lifetime Income

Now, I used to have a very carefully calculated retirement plan. I had a 401(k) through my old job. My ex-husband also had one and we contributed a fairly decent amount each pay period. I had stocks, I had an investment property...but as often happens during a divorce, all of those things went away once the dust settled and I began to live my new life as a single-income household - with a child still living at home. I am just now, after almost 4 years, regaining my financial footing and starting to think about what the rest of my life will look like - including my retirement.

You see, there is a huge difference in planning a retirement within a two-income marriage with existing assets, and planning retirement as a self-employed single woman. A VERY BIG DIFFERENCE. Many people in my situation may be under the mistaken impression that you can't plan for retirement when you are self-employed, when you are divorced, when your income may not be that high...but they are exactly that: mistaken. With the help of a Prudential financial professional, anyone, at any stage in their life, can plan for retirement! It's all about securing a protected lifetime income with the help of someone who knows that they are doing and can assist in creating a strategy to help you achieve the retirement of your dreams!

Learn Why You Should Be Thinking About Securing A Protected Lifetime Income

As we are all fully aware - or at least we should be - Social Security is not what it used to be, and we can't rely solely on Social Security income in our retirement years. We all receive that letter in the mail from the Social Security Administration each year, advising us as to how much we are estimated to receive. It is a frighteningly low amount! Yes, you may have a 401(k) through your employer, but even so, is that going to be enough? Studies show that most people will need an average of 70-90% of their pre-retirement income to live a comfortable life in retirement. Judging by my SSA statements, I will most definitely not be able to afford that little cottage on the beach that I so often dream of.

What is Protected Lifetime Income?

Have you ever heard of protected lifetime income? To be perfectly honest, I had never heard the term before I began working with Prudential, and I am someone who is pretty good with managing money. If you aren't familiar with the term, don't fret - just take this opportunity to educate yourself and take advantage of that newfound knowledge!

A protected lifetime income is just that - a "paycheck" that you receive in your retirement, that you receive as long as you live. One way of having protected lifetime income is through an annuity. An annuity is a long-term investment made with an insurance company, designed to provide income in retirement. The insurance company will provide you with income payments over a specific period of time, often for life, in exchange for a fee that allows them to protect that income. It can last your lifetime, so you won’t outlive your retirement savings.

Now, I knew a little bit about annuities because I worked for a financial advisor many years ago, and Angeline actually has an annuity that we set up with the proceeds of her father's life insurance policy. I have had such a peace of mind, knowing that that nest egg would be there for her when she needed something - and it was a relief when she needed a new car in 2018 and was able to withdraw a bit to help fund her purchase! I learned so much more about protected lifetime income, here's a little taste of what it's like to meet with a Prudential financial professional!

Research shows that protected lifetime income can lead to a more enjoyable and happy retirement.1 I mean, no one wants to go into retirement without some sense of financial security, it kind of takes all of the happiness of being retired out of the equation! You can learn more about protecting your retirement with lifetime income here: smarturl.it/PruAnnuities.

Sometimes we women face unique challenges when it comes to retirement income planning, especially if we are single mothers, divorced, or widowed. Thankfully, Prudential has the expertise and solutions for protected lifetime income to help solve these challenges with Prudential annuities and financial solutions. Click here to set up a complimentary meeting with a Prudential financial professional today: smarturl.it/FtLForm. I will be conducting mine very soon, and I couldn't be more excited to start planning for my future in a very real way!

Source: 2018 Guaranteed Lifetime Income Study, Greenwald & Associates and CANNEX

Leave a Reply