Thank you CreditRepair.com for sponsoring this post. CreditRepair.com’s team understands that a credit score is not just a number; it's a lifestyle.

As many of you already know, I have been divorced now for several years (June will be five years!). Divorce is a very scary thing and it takes some time to begin living some semblance of a normal life once the dust settles, and one VERY important area of divorced life is your credit! I wanted to fully heal and basically start off on a fresh page once the divorce was final, so to speak. Ultimately, I wanted the chance to rebuild my life and in order to do that, I knew that I needed to rebuild my credit in order to achieve financial freedom. After all, It was time to LIVE again! With the new year comes new goals, and for many, that means taking control of finances. Though it can be overwhelming to take the first step in gaining financial control, CreditRepair.com can help! Read on to find out How to Repair Your Credit After a Divorce with CreditRepair.com!

How to Repair Your Credit After a Divorce with CreditRepair.com

CreditRepair.com is a leading provider of credit report repair services in the United States consisting of a team of credit professionals who educate and empower individuals to achieve the credit scores they deserve. They offer a FREE credit report summary, a FREE personalized credit report consultation as well as a FREE score evaluation and game plan if you call or sign up online at CreditRepair.com.

What kind of plans does CreditRepair.com offer?

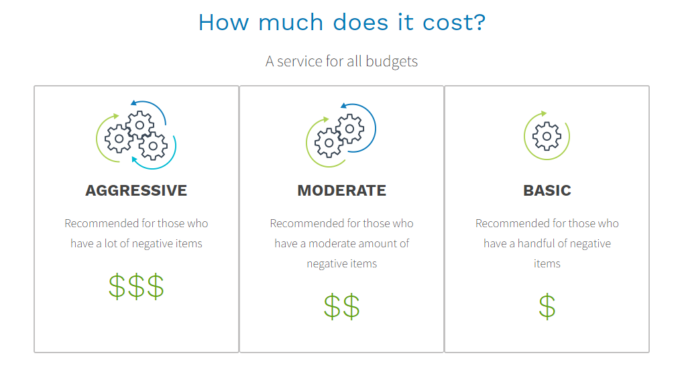

They have several plans to fit your budget and your needs, depending on if you have a lot of negative items on your credit, a moderate amount or basic amount.

Did you know that a score lower than 650 is considered bad? Most people don't know just how much your score can affect your future. Are you in need of a new car? Dreaming about becoming a homeowner? Let's face it, you won't be able to do any of these things with a bad score. Your credit score is not written in stone, and you are more than a credit score. But your credit won’t fix itself.

Get help from CreditRepair.com today with a free consultation and kick start your credit repair efforts!

Even if you have no major plans for this new year, we all have another common goal and that is to SAVE money, am I right? In the days after my divorce - okay, YEARS - I found that I was using my credit cards more often than not and found that I was LOSING tons of money due to the high interest rates! I felt as if I was throwing my money right into the garbage can. Very little of my payments were actually going towards the principal balance because of high interest charges due to my low credit score. I was totally wasting money and if I had better credit, I would have qualified for credit cards with lower interest rates. Better credit could save you thousands of dollars in high interest rates. Past clients of CreditRepair.com have seen an average score increase of 40 points in just four months (* Not all clients saw such a result as all legal cases are different. You should not expect to see the same result and it is not guaranteed.). Lower interest rates means that I can book more trips (perhaps a trip back to Germany this fall for the Christmas markets!) because I have more disposable income!

Another key component to achieving good credit is also maintaining good credit! We don't always have the time and the resources to stay on top of our credit. Your credit score changes frequently and you need to ensure that everything is correct. CreditRepair.com’s technology provides members with a personal online dashboard, a credit score tracker and analysis, creditor and bureau interactions, text and email alerts, mobile apps and credit monitoring. Your credit is made up of two things. Your credit score as well as your credit report. Your credit report contains your name and address, your loan information, credit limits, account names, credit history, credit inquiries, public record, collections, and late payment information. Your credit score is calculated based on the information in your report.It’ really is your entire financial history. At CreditRepair.com, they make sure you are notified of any changes that could affect your score, the good changes as well as the bad.

I have been slowly but surely improving my credit score since my divorce in 2015, and I recently was able to take a home equity loan to remodel my home...and book a trip!! Back to St Pete I went, for their annual Localtopia festival downtown, with a great rate on a rental car and earning rewards points for my trip through my brand new credit card with a GREAT interest rate...because my credit has improved!

I am hoping you will be seeing more good changes to your score in 2020 and for years to come! Check out CreditRepair.com and sign up today!

Leave a Reply