In today's consumer-driven society, it's all too easy to fall into the trap of overspending, so we're giving you some Financial Tips for Chronic Over-Spenders. With access to online shopping, credit cards, and the allure of instant gratification, many individuals find themselves spending beyond their means.

Chronic overspending can lead to significant financial setbacks, accumulated debts, and an uncertain financial future. However, with awareness, commitment, and a set of strategic approaches, over-spenders can regain control of their finances and pave the way for a brighter financial future.

Financial Tips for Chronic Over-Spenders

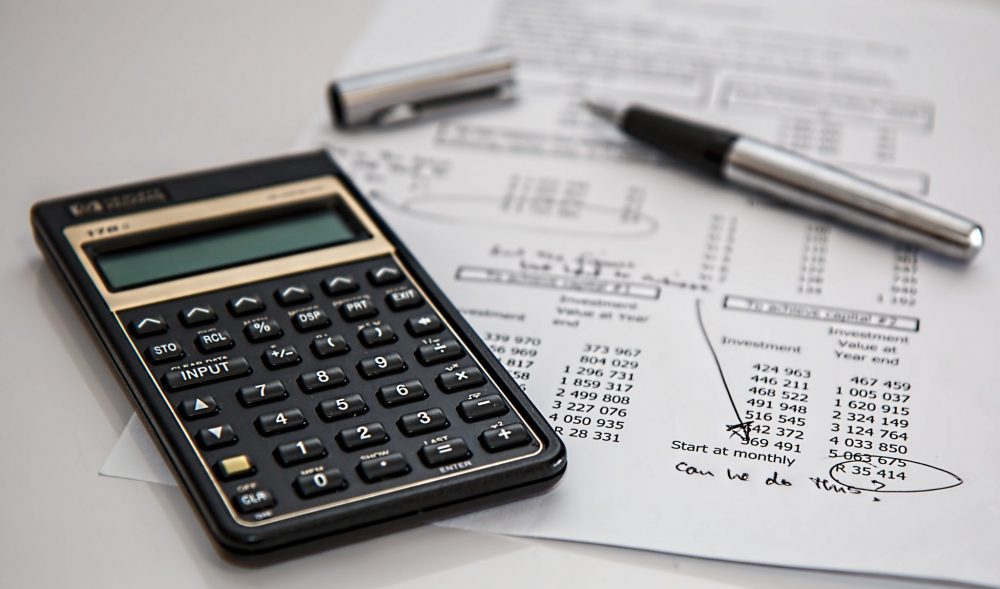

For those committed to reversing their spending habits, one often-suggested piece of advice is to open an ISA or Individual Savings Account. While this specific investment vehicle is more prevalent in the UK, the underlying message is universal: setting aside a portion of your income for savings or investments.

By doing this, not only do you safeguard your financial future, but you also invest in your future, ensuring that your money grows over time. In the US, there are various equivalent investment and savings options to consider.

Recognize the Problem

The first step to tackling any issue is acknowledging its existence. Take an honest look at your spending habits. Are they sustainable? Do your expenses regularly exceed your income? Recognizing the severity of the situation is the first move towards initiating change.

Develop a Comprehensive Budget

A well-structured budget is paramount for chronic over-spenders. List all your monthly expenses, including bills, groceries, entertainment, and any debts. Once you have a clear view of where your money goes each month, it's easier to identify areas where cuts can be made.

Reduce Impulse Purchases

Impulse buying is a common trait among chronic over-spenders. Consider implementing a waiting period before making significant or non-essential purchases. Giving yourself time can reduce the chances of making purchases you'll later regret.

Limit Credit Card Use

Credit cards, when not used judiciously, can exacerbate overspending. Consider using cash or debit for daily expenses to become more aware of the money you're spending. If you have multiple credit cards, think about consolidating them or setting a lower spending limit.

Invest in Your Future

As earlier stated, dedicating a portion of your earnings towards investments can secure your financial future. Explore avenues like stocks, bonds, mutual funds, or retirement accounts. The power of compound interest can be a game-changer for your financial health in the long run.

Establish an Emergency Fund

Before investing, ensure you have an emergency fund. This is a savings cushion that can cover 3-6 months of living expenses. Having this fund prevents you from diving into savings or investments in case of unexpected expenses.

Seek Professional Advice

Sometimes, the best approach is to consult with a financial advisor. Professional guidance can provide you with personalized strategies based on your financial situation. They can help with debt management plans, investment options, and savings strategies that you might not have considered or known about.

Unsubscribe from Marketing Emails

Marketing emails from your favorite stores can tempt you into buying items you don't need. Unsubscribe from these emails and marketing lists to reduce the temptation. The 'out of sight, out of mind' principle can be particularly effective here.

Understand Your Spending Triggers

Are there specific emotions, situations, or people that encourage your spending? Understanding your triggers can help you develop strategies to avoid or combat them. It might involve changing your routine, seeking emotional support, or finding different, non-financial ways to respond to these triggers.

Set Financial Goals

Have clear, achievable financial goals. Whether it's saving for a house, car, or vacation, having a tangible objective can make the saving process more focused and rewarding. Visualize your goals, perhaps by creating a vision board or using an app that tracks your progress.

Practice Mindful Spending

Mindful spending involves making deliberate choices about what you purchase, ensuring you get value for your money, and aligning your spending with your values. Ask yourself: "Do I need this? Why do I want this? Could this money be better used elsewhere?"

Leave a Reply