Is most of your paycheck going toward household expenses? Nowadays, this is not an uncommon situation. Many people have no money to spend on anything other than necessities. Obviously, this creates stress and lowers your quality of life.

So how can you reduce your expenses without turning your whole lifestyle upside down? Here are 4 simple ways to reduce your household expenses.

Cancel Unnecessary Phone, Internet or TV Services

Do you pay for cable or satellite television but are barely home to watch it? If so, consider pulling the plug. Cable and satellite television subscriptions can be costly, especially with the addition of premium channels.

The good news is that there are other ways to watch TV, such as Netflix, Hulu and SlingTV. Even if you do watch cable or satellite TV, these options are cheaper, with much lower monthly costs, and you can still keep your internet service.

As far as your phone bill goes, review your bill to see which services you can do without. For instance, consider downgrading your data plan. Many people don't use as much data as they pay for.

Schedule Regular HVAC Maintenance

Regular maintenance of your HVAC system with Wood AC can reduce your monthly energy bill. An HVAC system that isn't working to its full potential is inefficient. If you let it continue to run without ever getting it serviced, it will eventually fail.

According to IAQA (Indoor Air Quality Association), scheduling regular maintenance can reduce the chances of a major HVAC repair by as much as 95%.

Consolidate Your Insurance Policies

Most people have auto insurance, homeowners insurance, and life insurance policies, and they're often with different companies. By buying all your insurance policies from one company, you can usually lower your rates because most insurance companies offer multiple line discounts.

Though it might seem like a hassle to switch your policies, it will be worth it in the long run.

Don't Dine Out as Often

You'll save a bundle if you cut down on eating out. Home-cooked meals tend to be healthier than restaurant meals anyway. This might be tough if you hate to cook or if you're a social butterfly, but if you must eat out, there are ways you can save on restaurant meals.

At buffets and fast food restaurants, you can get an entire meal for less than $10. Also, before you go out to eat, look for coupons for the restaurant you'll be eating at. Many restaurants have apps that you can use to get special discounts.

Do It Yourself

If there are certain things that need to be fixed or updated around your home, save money by doing it yourself. Hiring professionals can be expensive. One easy do-it-yourself project is painting the interior of your house.

It's even easier if you get the help of some friends and family and do it together.

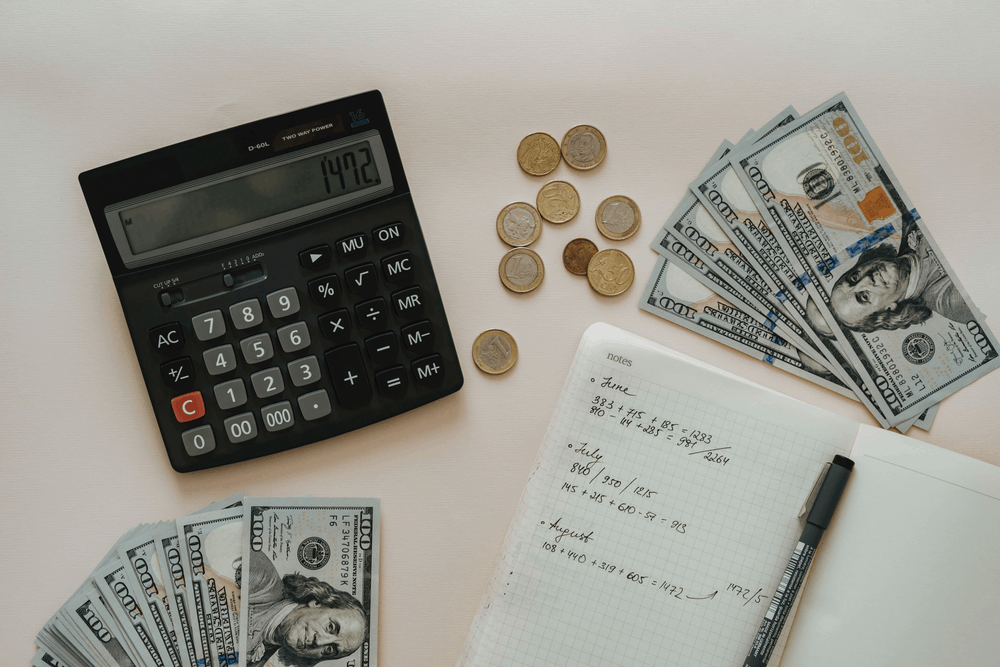

If you live from paycheck to paycheck, try these simple ways to cut down on expenses. Though the potential savings might seem small to you, they'll add up, and you'll find that counting pennies actually works.

Leave a Reply