Florida is a retirement paradise for seniors from north of the border. These snowbirds abandon the months filled with ice and snow in favor of beautiful ocean views, sandy beaches, and warmer weather. Some of them just want to wait out the bitter winter and then fly back home when spring has finally sprung, while some plan on living in the sunshine state for the rest of their lives.

But, is that the greatest plan for seniors to follow? Is it better to move far away for retirement, or is it better to find a charming getaway closer to home? These are questions you should go over to make sure your parents are happy with their retirement plans, and they will help you map out your own retirement plans in the future. Look at some of the benefits that come with finding a place that’s nearby.

Is It Better for People to Retire Closer to Home?

Being Close to Family:

One of the problems with being a snowbird is that your family might not be able to follow your migration pattern. Plane tickets are expensive. Work and school schedules are busy. They might not be able to visit you at all. You could find that you’re missing important moments because of the long-distance.

Joining a retirement community close to home lets you see your kids and grandkids as often as possible. That way, you won’t miss any major milestones and special occasions. You can be there for moments like your child announcing their engagement or a grandchild performing as the lead in a school play.

Plus, being a short drive away from the grandkids could be good for your health. Research has found that bonding with grandkids lowers your risk of developing Alzheimer’s disease and depression. This perk could be the key to your happiness.

Avoiding Financial Pitfalls:

Staying in Florida every winter (or longer) could complicate your taxes. Unless you decide to become a permanent resident, you may have to file taxes for the CRA and the IRS in the same year. The tax pitfalls are difficult enough that you should think about hiring an accountant to figure out the payments and the filing processes.

More importantly, you’re going to have to think about healthcare costs. The States don’t have universal healthcare, which means that a visit to the doctor or emergency trips to the hospital could give you some serious sticker shock. Without health insurance, a visit to the emergency could cost you anywhere between $150 to $3,000 — it could be more if you need to have surgery or long-term care.

Skipping Travel:

Air travel can get uncomfortable as you age — this is especially true if you have mobility issues or physical ailments. You will have to make your way to a large airport, wait in line to get through security and then sit in a cramped seat for hours at a time. Eventually, you might not want to go through the exhausting experience. Other forms of travel may be easier to handle.

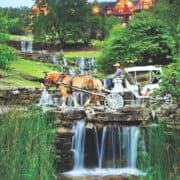

A retirement facility near home may not have palm trees, but it has lots of benefits that could make living there feel like a piece of paradise. Maybe your retirement getaway is closer than you think.

Leave a Reply